Student Advice

Everyone has constraints on their time, money, and attention. My recommendations represent what I believe a competitive student should do to prepare for a career in finance but everyone has to make trade-offs.

University Selection

The most valuable aspects of a college education are: degree, personal network, learning from peers, and coursework. When considering universities with different tuition rates, consider whether the higher tuition comes with a substantial increase in one of those factors. While there are substantial differences in the marketability of an Ivy League degree relative to a state college degree, most of the differences in outcomes from similar colleges are determined by individual factors.

People only care where you graduate. Spend 2-4 semesters at a state college to save money, get a high GPA, and get a scholarship to transfer to a better school. Make sure to take your general education classes at the cheap school and take as many of your major classes as possible at the better school. Plan ahead for transfer credit.

Course Selection

Take the required finance course for business majors as soon as possible. (This is usually called Financial Management.) It is a prerequisite to almost every finance course at every university. After that, take Investments as soon as possible. It will help with the second internship if you want to work in capital markets. Next, take a modeling class and an international finance class. Finally, take the Financial Markets and Institutions class and any other required classes for your program. If you want to work in capital markets, get into the student managed fund.

Finance is a interdisciplinary field. Without accounting, economics, and statistics, you cannot understand finance. The qualitative coursework in marketing and management will help you evaluate the strategies of potential investments as well as the strategy of your own organization.

If you are not a finance major, consider your alternatives carefully. In general, more quantitative skills lead to higher salaries. Don’t expect to have a job in the arts or humanities and own a house without support from a spouse or parents. Even within the business school, there are substantial differences between more quantitative majors versus qualitative majors. Consider the median salary and lifestyle rather than a few stories of students that “made it”.

If possible, do a semester abroad in the first 2 years. It is better to do it early than to miss an internship opportunity later. Pick a country where you do not feel comfortable. Studying abroad in a less developed country may be cheaper than a state college in the U.S. and provides a much more valuable experience. Don’t limit yourself to the programs that the university promotes.

Pick a class you like with a project that interests you. Work harder on the project than is required and publish the results. This is not as difficult as you might imagine and is marketable even if you don’t go to grad school. Your professor knows places that will publish student work.

Internships

Get an internship at the end of your sophomore year and junior year. Even if you have never taken a class in your discipline, get an internship. Companies expect you to be motivated and interested in your field. They do not expect you to know how to do the job. Many companies will make full time offers to a few of their top performers in the summer internship. Do not accept unpaid internships. Everyone believes their experience is valuable but very rarely is it worth going into debt.

Academic and Career Standards

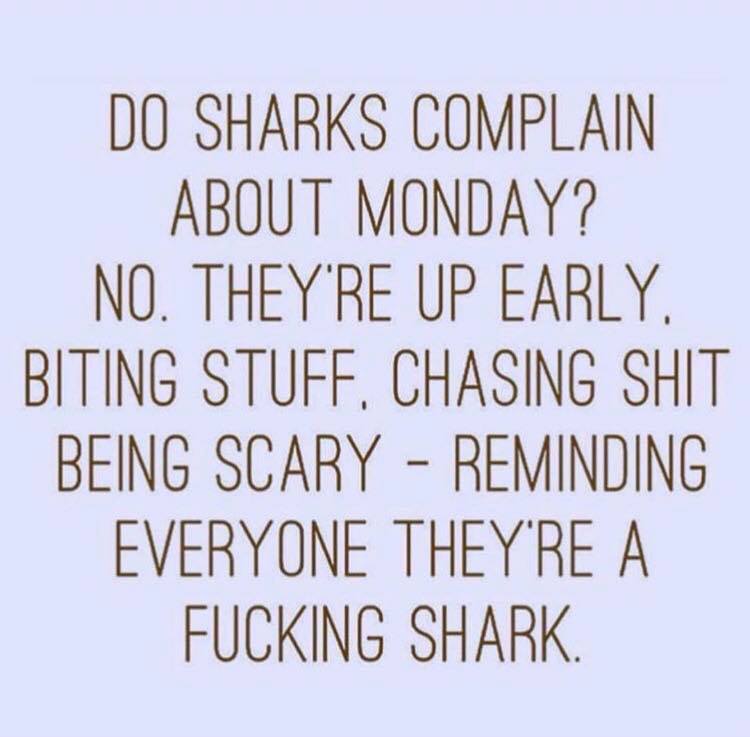

Assume that you need to do twice as much as what other people have done to achieve the same level of success. Being above average doesn’t cut it in finance. Many people reached their position by some combination of luck and skill. Don’t assume that you can replicate someone else’s luck.

Marketable Skills

You can never know Excel well enough. You can never network enough. Do not accept labels such as qualitative or quantitative. Finance requires both.

Start learning to stand in front of people and explain difficult ideas. This is necessary for most jobs in finance.

It is better to ask stupid questions than to not ask questions.

Learn some programming. R, Python, Matlab, SAS, or even VBA are good choices. Pick a project to learn on your own. This is more efficient than taking a general introduction to programming class. Someone has probably solved a problem similar to your’s on free sites like Stack Overflow. Break down your project into the most simple components and search for how to complete each step.

Resume Hacks

Identify extracurricular activities that have measurable outcomes to list on your resume such as: organized 20 presentations or raised $10,000 for charity.

“Don’t Follow Your Passion” - Mike Rowe

Get a hobby. Find something that is not finance that makes you happy. This will help you deal with the times when finance will be boring, frustrating, or too difficult. Talk about your hobby in an interview.

The best jobs are usually not around the university and are not advertised at the career center. Be prepared to move and find your own job.